Running a small business comes with many responsibilities, and managing taxes is one of the most important. Understanding the available tax deductions can save your business money and increase...

Choosing the right business structure is a crucial decision that impacts your taxes, liability, and overall business operations. Two of the most popular options for small business owners in...

Managing payroll taxes can be one of the more complex and time-sensitive aspects of running a business. But understanding the basics helps you stay compliant, avoid penalties, and keep...

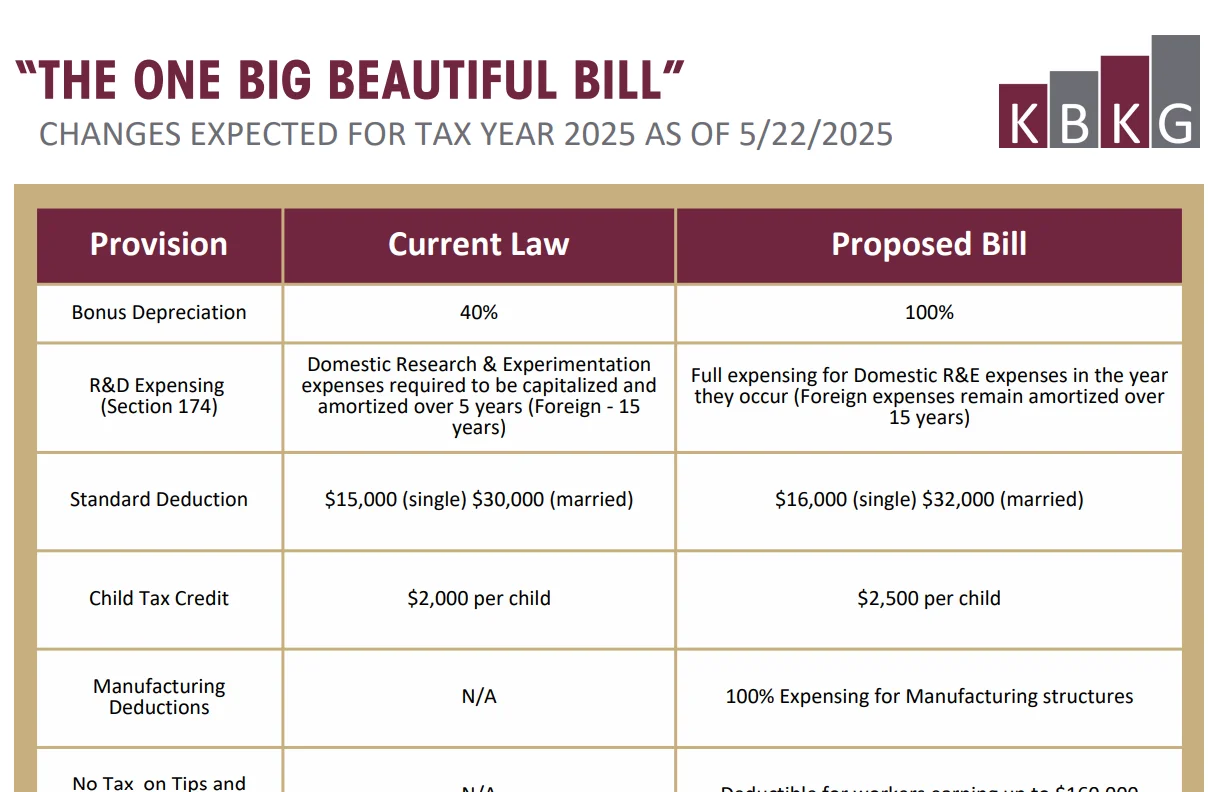

The One Big Beautiful Bill – KBKG Provision Current Law Proposed Bill Bonus Depreciation 40% 100% R&D Expensing (Section 174) Domestic Research & Experimentation expenses required to be capitalized...

Receiving a notice from the IRS can be stressful, but it doesn’t always mean you’ve done something wrong. IRS notices are often sent to clarify information, request additional documents,...