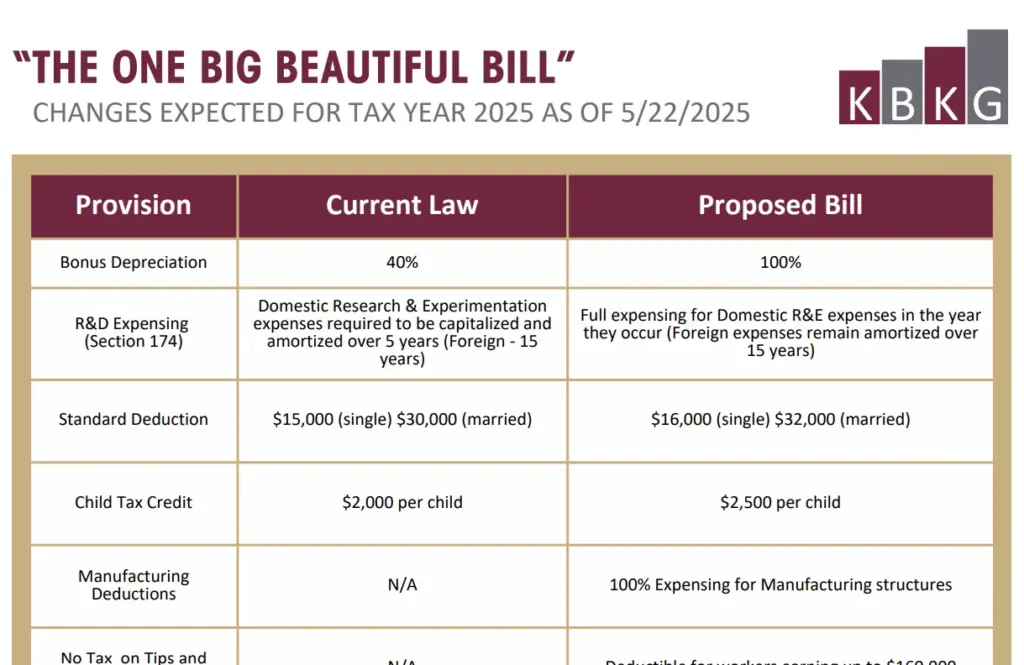

The One Big Beautiful Bill – KBKG

| Provision | Current Law | Proposed Bill |

|---|---|---|

| Bonus Depreciation | 40% | 100% |

| R&D Expensing (Section 174) | Domestic Research & Experimentation expenses required to be capitalized and amortized over 5 years (Foreign - 15 years) | Full expensing for Domestic R&E expenses in the year they occur (Foreign expenses remain amortized over 15 years) |

| Standard Deduction | $15,000 (single) / $30,000 (married) | $16,000 (single) / $32,000 (married) |

| Child Tax Credit | $2,000 per child | $2,500 per child |

| Manufacturing Deductions | N/A | 100% Expensing for Manufacturing structures |

| No Tax on Tips and Overtime | N/A | Deductible for workers earning up to $160,000 |

| Auto Loan Interest Deduction | N/A | Up to $10,000 for U.S. assembled vehicles, phasing out for incomes >$200k married filing jointly and >$100,000 for single filers |

| Adoption Credit | Up to $17,280, non-refundable | $5,000 of current credit made refundable |

| Deductions for Seniors | $1,600 for age 65+ | Increase of $4,000 for age 65+ for individuals ($5,600 total), phase out for incomes over $150,000 married filing jointly and $75,000 for single |

| 1099-K | $2,500 | $20,000 and >200 transactions |

| SALT | $10,000 cap | $40,000 cap, phasing out at incomes >$500,000 |

| 199A Flow-Through Deduction | 20% | 23% |

| Interest Deductions | EBIT Standard | EBITDA Standard |